On January 1, the new environmental tax that falls on non-reusable plastic containers came into force.

As we have already informed you in previous posts that you can consult in our Media Room on the web – “The Order that regulates the Special Tax on Non-Reusable Plastic Containers enters into force“, among others -, the new tax is levied on manufacturing, intra-community acquisition and import not only of non-reusable packaging, but also of secondary and tertiary packaging that contains plastic. With this delimitation of the objective scope, practically any company that operates in Spain and that buys packaged goods from abroad becomes a taxpayer for the tax. Certain exemptions are only provided for some pharmaceutical or agricultural products, as well as an exemption for those taxpayers who purchase less than 5 kilograms of single-use non-recycled plastic per month. The expected rate is 0.45 euros per kilogram of non-recycled plastic.

Taxpayers of the new tax must request registration in the territorial registry of the AEAT Management Office in which the establishment carries out its activity, to obtain a plastic identification code; They also have to present monthly or quarterly self-assessments (Forms 592 and A22), as well as keep separate accounts through the electronic office for these purposes.

Currently there is no regulation that helps to interpret this new tax, so the only source of interpretation will be the frequently asked questions document published by the AEAT.

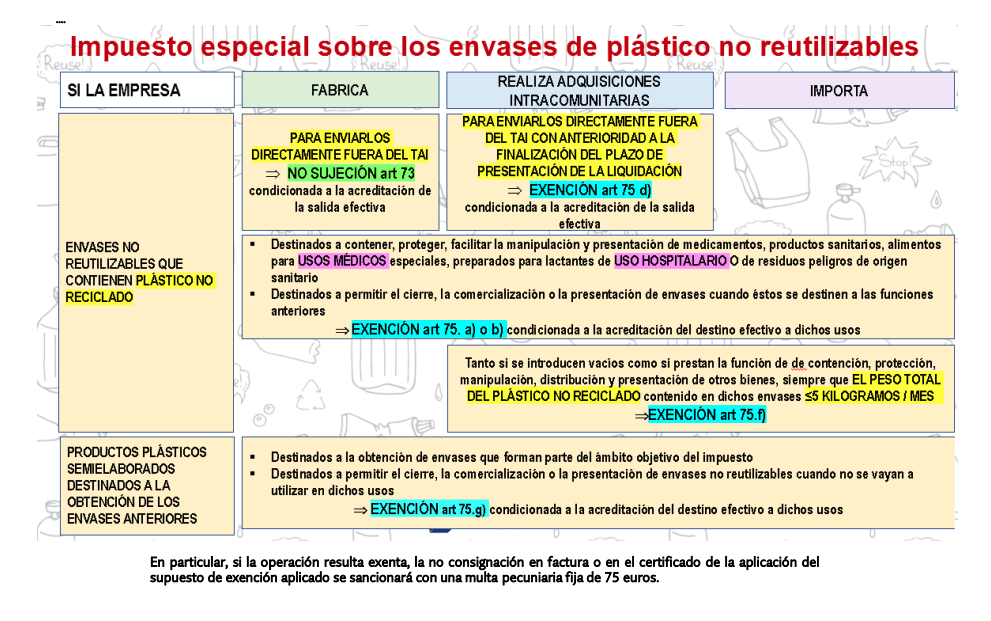

Compartimos con vosotros dos útiles gráficos de decisión publicados por el Boletín de Primera Lectura, que os ayudarán a saber si estáis sujetos a este nuevo Impuesto sobre el plástico:

We are hereby sharing with you two useful decision graphs published by the Primera Lectura Bulletin, which will help you to know if you are subject to this new tax on plastic:

At addwill we will be happy to help you with any doubts or questions that may arise in this regard, or if you wish to expand the information or require advice on this subject from our professional experts.

You can contact us by phone + 34 934 875 200 or at email info@addwill.eu.