What is the solidarity contribution?

The new solidarity contribution introduces an additional charge for income that exceeds the annual maximum contribution base, set at 4,720.5 euros per month for the year 2024. This measure, approved in 2023, will come into effect starting in 2025.

In March 2024, the Government detailed the operation of this contribution through a specific regulation. The additional contribution will apply to the portion of the monthly salary that exceeds the maximum contribution base, which was previously not subject to Social Security contributions.

How will the solidarity contribution be applied?

Starting in 2025, the solidarity contribution will be implemented as follows:

- 0.92% additional for income that falls between the maximum contribution base and up to 10% above it.

- 1% additional for income that is between 10% and 50% above the maximum base.

- 1.17% additional for income that exceeds 50% above the maximum contribution base.

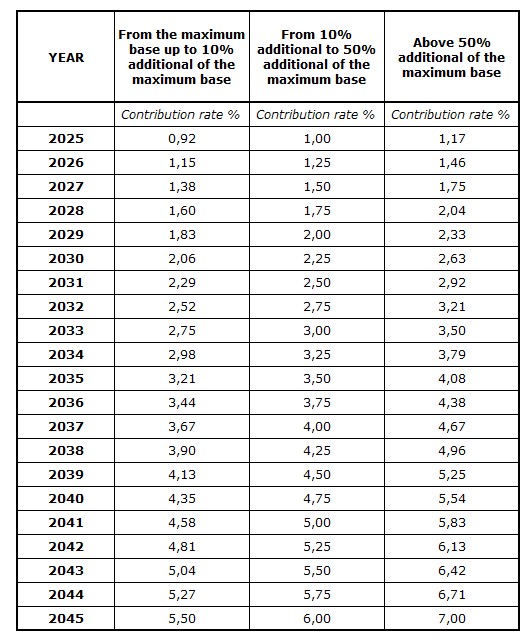

This percentage will increase annually by 0.25 points until 2045, reaching the following levels:

- Segment 1: From the maximum base up to 10% additional, with a contribution of 5.5%.

- Segment 2: From 10% to 50% above the base, with a contribution of 6%.

- Segment 3: For income exceeding 50% additional to the maximum base, with a contribution of 7%.

Progression of the solidarity contribution (2025-2045)

Table – Solidarity Contribution

Distribution Between Worker and Company

The distribution of the contribution corresponding to this additional solidarity contribution will follow the same proportion established for contributions for common contingencies, in accordance with Article 72 bis of Royal Decree 322/2024.

The total contribution for common contingencies is 28.3% of the worker’s salary. Of this amount, the company contributes 23.6% and the worker contributes 4.7%. In percentage terms, the company covers approximately 83.39% of the total contribution (23.6% of 28.3%), while the worker contributes the remaining 16.61% (4.7% of 28.3%).

Affected Workers

The solidarity contribution will apply to those workers whose income exceeds the maximum contribution base:

- Employees of the General Social Security Regime.

- Employees under the Seafarers’ Regime.

- Self-employed individuals in the Special Regime for Seafarers.

At addwill, we specialize in labor advice. If you have questions or need advice in this area or wish to schedule an appointment, our labor department experts are available via email at laboral@addwill.eu, phone at +34 934 875 200, or by clicking here.