As of January 1, 2025, new Social Security contribution rates for self-employed workers in Spain have come into effect.

Contribution Rates for 2025

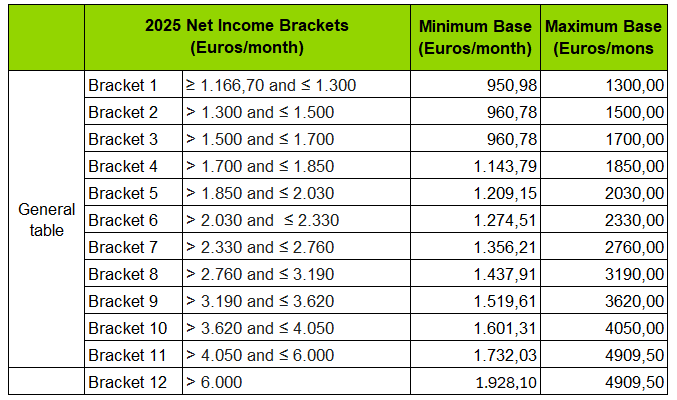

This year, the maximum contribution base is set at €4,909.50 per month. The applicable contribution rates will depend on your net income, as outlined in the table below.

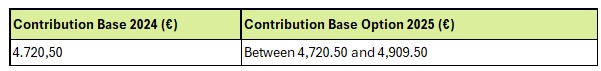

New Option for High Earners

Self-employed workers who were contributing €4,720.50 per month as of January 1, 2025, can apply to adjust their contribution base to any amount between this figure and the new maximum of €4,909.50 per month. The deadline to request this change is March 31, 2025.

If you need further information or a personalized contribution simulation, feel free to contact our labor department. We’re here to help—reach us via email at laboral@addwill.eu, by phone at +34 93 487 52 00, or by clicking here.