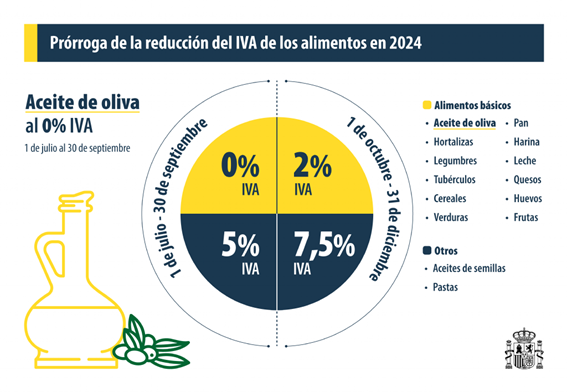

As of October 1, the Value Added Tax (VAT) on essential food items has temporarily gone up, after the government’s exemption for these products, including olive oil, ended in June.

For the rest of the year, the VAT rate on items like milk, bread, flour, fruits, vegetables, legumes, cereals, tubers, cheese, and eggs will be 2%.

Starting January 1, 2025, the rate will return to the reduced 4% for basic food items.

Meanwhile, seed oils and pasta, which previously had a reduced VAT of 5%, will now increase to 7.5% until the end of the year before going back to the usual 10% rate next year.

This change comes in response to the European Commission’s request for member states to begin phasing out the temporary measures introduced in recent years to cope with international crises like the conflicts in Ukraine and the Middle East.

Regarding olive oil, the government has promised to classify it as an essential food item permanently, meaning that starting in January 2025, it will also benefit from the reduced 4% VAT rate.

These adjustments aim to balance previous support measures with a return to normal tax levels.

If you need advice on how these changes may affect your business or household budget, feel free to reach out to us at +34 934 875 200, via email at comunicacio@addwill.eu, or by clicking here.

FOTO: https://www.lamoncloa.gob.es/