Individuals who have obtained benefits through cryptocurrency investments and do not declare them in their income tax return could face penalties of up to 150% on the taxes they owe to the tax authorities for those gains.

Currently, the sale of cryptocurrencies is taxed in a similar way to the sale of any other conventional asset, that is, as a capital gain or loss that is included in the taxable base for savings. The different tax brackets for the 2022 fiscal year are applied as follows: for gains up to 6,000 euros, 19%; between 6,000 euros and 50,000 euros, 21%; between 50,000 euros and 200,000 euros, 23%; and for over 200,000 euros, 26%.

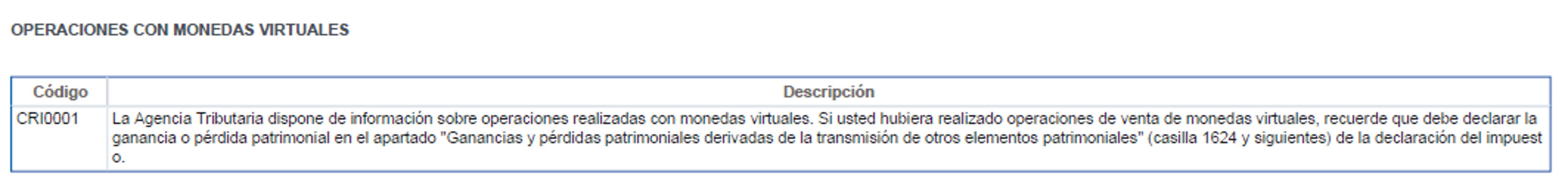

Since 2021, the tax authorities require the declaration of cryptocurrencies in the income tax return, and they sometimes include specific warnings about this obligation in the draft of the taxpayer’s fiscal data.

However, only the transactions that generate a variation in assets need to be declared. Therefore, if a user has purchased digital assets and has not touched them in the hope that their value will increase, there is no need to declare them. But if they have made sales, received rewards, or exchanged cryptocurrencies for others, they will need to declare it. Furthermore, starting from 2022, losses must also be included in the income tax return filed in 2023.

Regarding the exchange of cryptocurrencies, if they have been exchanged instead of sold, it is considered a capital variation and is defined as a barter for tax purposes. The difference between the purchase price and the exchange price must be taxed as a gain or loss.

In the case of Airdrop, when a company gives away cryptocurrencies to users for marketing actions, such as promoting it or taking courses, the user must also declare and pay taxes on them. In this case, the received gain must be reflected, that is, the value of the asset in the market at the time it is received.

At addwill, we are pleased to offer our assistance in clarifying any questions or issues that may arise, or if you need more information or advice from our experts in the tax department.

Feel free to contact us via phone at +34 934 875 200, by email at info@addwill.eu, or by clicking here.