In this post, we address recent modifications in the fiscal realm that affect compensations for travel expenses, and we provide a summary of the amounts exempt from taxation for accommodation and subsistence expenses.

The recently approved regulatory modification involves an increase in the tax-exempt amount for travel expenses in the Personal Income Tax (IRPF). It has been raised from 0.19 to 0.26 euros per kilometer, as established by Order HFP/792/2023, dated July 12, 2023, with effects starting from July 17, 2023.

This update in the regulations is relevant both for employees incurring these expenses and for the companies providing them.

Here is a summary of the situation regarding all allowances for travel, subsistence, and accommodation:

1.Allowances for Travel Expenses

Amounts intended to compensate for travel expenses arising outside the regular place of work, such as factories, workshops, or offices, will not be subject to taxation, provided the following requirements and maximum amounts are met:

a) If the employee chooses to use public transportation, the company will reimburse the specific amount of the expense, provided proper justification is provided through an invoice or equivalent document, such as an airplane or train ticket.

b) In case of using private transportation means, the amount to be received will be calculated by multiplying 0.26 euros by the number of kilometers traveled, as long as the travel is adequately justified. Additionally, toll and parking expenses reimbursed by the company and properly justified can be included.

The modification, as we have explained, is that from July 17, 2023, the exempt amount for these expenses has increased from 0.19 euros to 0.26 euros per kilometer traveled for those employees or workers who do not use public transportation. This measure also applies to taxpayers who earn employment income derived from special dependent work relationships, as long as they do not use public transportation, and the expenses are not specifically reimbursed by the companies they work for.

2.Subsistence and Accommodation Allowances

Sums allocated by the company to compensate workers for normal subsistence and accommodation expenses in restaurants, hotels, and other hospitality establishments are exempt from taxation, as well as from the withholding tax system, under the following conditions:

1) Subsistence and accommodation expenses must occur in a municipality different from the one where the employee’s regular place of work is assigned, as well as from the one where the worker’s residence is located.

2) The travel and stays of workers in the same municipality (different from the place of regular work and residence) cannot exceed nine months continuously without interrupting the mentioned permanence due to temporary absences for vacations, illness, or other circumstances that do not imply a change of destination.

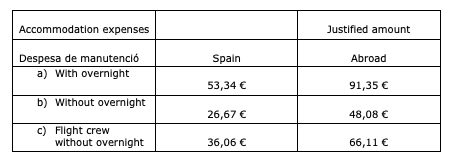

3) The maximum daily amounts not subject to taxation are listed in the following table. Although these amounts represent the maximum limit, they may not cover the actual expenses incurred by the worker. However, this does not authorize additional deductions in the Personal Income Tax (IRPF) for the difference. Neither is it possible to make any deduction, even if the amount with which the company compensates the worker is lower than those maximum amounts.

DAILY AMOUNTS EXEMPT FROM TAXATION FOR ACCOMMODATION AND SUBSISTENCE

At addwill, we will be glad to assist you with any questions or inquiries that may arise in this regard, or if you wish to expand the information or require advice from our experts in the tax department.

You can contact us via phone at +34 934 875 200 or email us at info@addwill.eu.