We would like to remind you that as of January 1st, 2023, a NEW CONTRIBUTION SYSTEM FOR SELF-EMPLOYED INDIVIDUALS has come into effect.

From now on, self-employed individuals will have the option to choose between the minimum and maximum contribution bases within their income bracket.

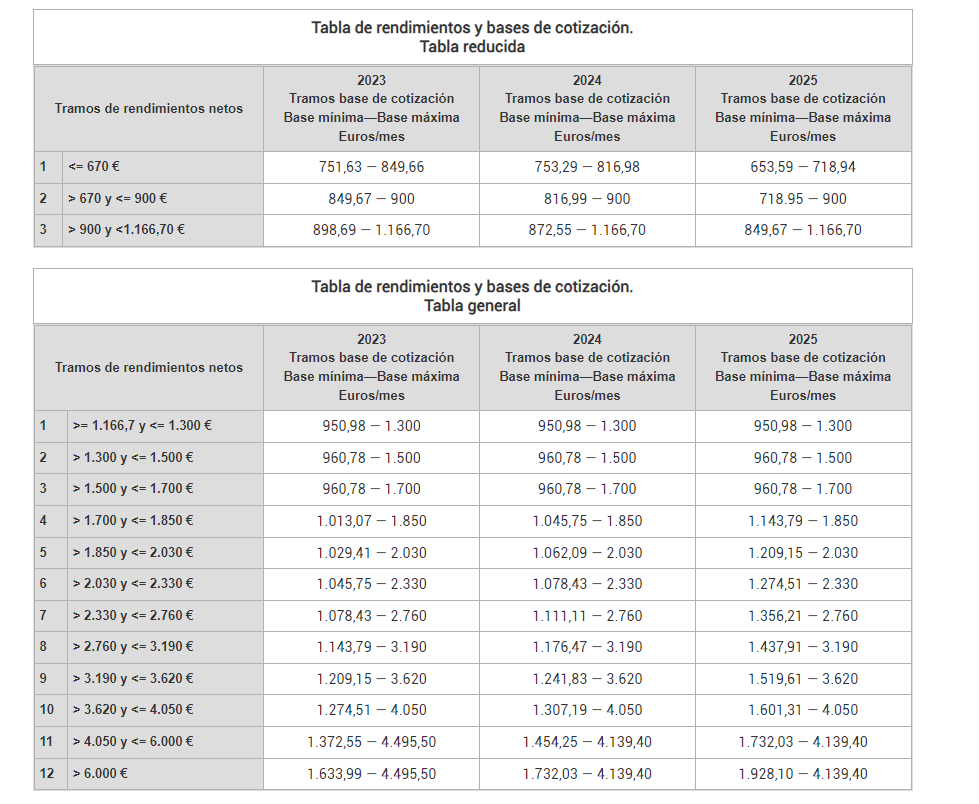

Recently, the Social Security has published a table with the 15 contribution brackets for the year 2023, divided according to whether the contribution is “reduced” or “general.”

We present the contribution table for self-employed individuals in 2023:

Here we present an illustrative example:

The minimum fee for a self-employed person with over 6,000 euros in net income, applying for the minimum base:

- 1,633.99 € * 31.20% = approximately 509.80 euros per month.

The monthly bases selected each year will be provisional until the annual regularization of the contribution takes place.

At the end of the calendar year, the Social Security will cross-check the annual income data with the Tax Agency. If the selected contribution is lower than the reported income, the Social Security will inform you about the difference, which must be paid before the last day of the month following the notification received.

If the contribution has been higher than the corresponding annual income, the Social Security will refund the difference before April 30th of the following year.

Starting from 2023, self-employed individuals have the option to change their contribution base up to 6 times, within the applicable minimum and maximum limits.

They can modify their contribution according to their projected net income, after deducting the costs related to their activity, within the following deadlines:

- From January 1st to February 28th or 29th: with effects from March 1st.

- From March 1st to April 30th: with effects from May 1st.

- From May 1st to June 30th: with effects from July 1st.

- From July 1st to August 31st: with effects from September 1st.

- From September 1st to October 31st: with effects from November 1st.

- From November 1st to December 31st: with effects from January 1st of the following year.

We remind you that you have until October 31st, 2023, to indicate the provisional bases for this year.

For any inquiries, please do not hesitate to contact our labor department at the email address laboral@addwill.eu or by phone at +34 93 487 52 00. We will be glad to assist you.