Pensioners can claim refunds for contributions to Labor Mutuals and substitutes made before 1967 and between 1967 and 1978, because at the time they were not allowed to deduct them in their returns.

As a result of Supreme Court rulings in 2023 and 2024, and according to the second transitional provision of Law 35/2006 of the IRPF, most pensioners can request a refund of these contributions by reducing work income in the 2023 IRPF return and in previous non-prescribed periods (2019-2022) through a form on the AEAT website.

Which pensioners can request a refund?

a) Pensioners of the INSS or Social Institute of the Navy:

Contributions before 01/01/1967:

According to Supreme Court ruling 673/2024, these contributions should not be taxed in full. Example: Of a pension of €30,000 per year, if €1,000 comes from contributions before 1967, this €1,000 is not included in the IRPF return.

Contributions between 01/01/1967 and 12/31/1978:

Supreme Court rulings (255/2023 and 1644/2023) determine that only 75% of these contributions should be taxed. Example: Of a pension of €30,000, if €10,000 comes from this period, only €7,500 is taxed.

Contributions to substitute mutual before 01/01/1979:

The benefit will be reduced by 25%, taxing only 75%.

b) Supplementary pensions:

- General case: 25% reduction for contributions made before 01/01/1995.

- Paid by special funds of public entities: Pension supplements for public officials are entitled to a 25% reduction, meaning that only 75% of the pension will be taxed. This reduction applies to contributions made until 01/07/1987 if the supplement is paid by the “special fund of the INSS,” or until 12/31/1978 if the supplement is paid by “Muface,” “Mugeju,” or “Isfas.”

Procedure to request the refund

a) 2023 income tax return:

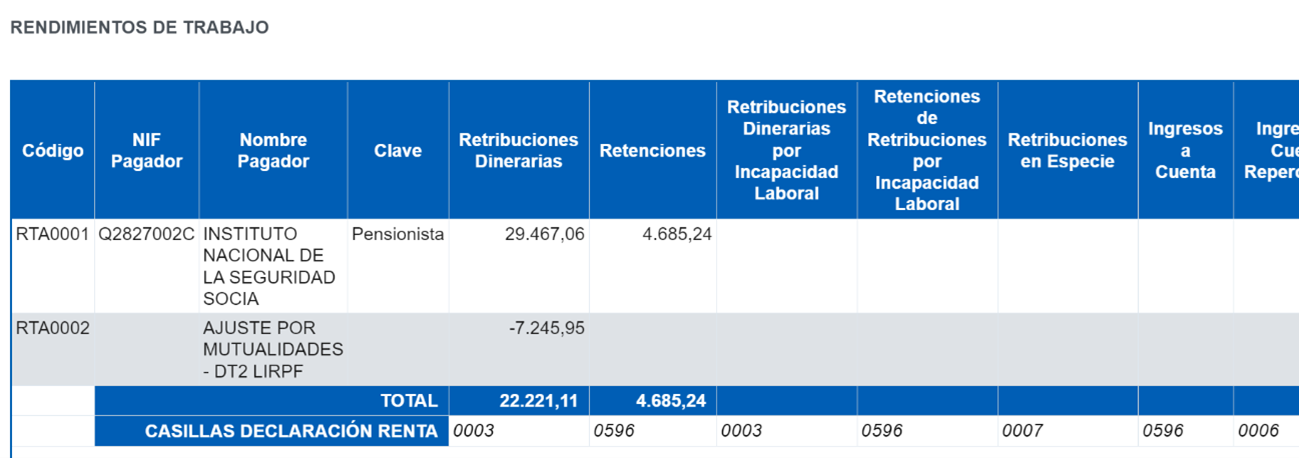

In 2023, the Tax Office has already calculated the reduction of work income to be applied to the pension for previous contributions made by each taxpayer. This reduction calculated by the Administration is shown in the tax data.

b) Previous non-prescribed periods (2019-2022):

The refund is requested through a form on the AEAT website, indicating personal and bank details. No additional documentation is initially required.

Heirs of deceased pensioners

Heirs can request a refund for the years 2023, 2022, 2021, and 2020. For deaths in 2023, the 2023 income tax return is filed with model H-100. For previous years, the AEAT web form is used, indicating the data of the deceased and the heir. No documentation is initially required.

This guide allows pensioners and their heirs to understand and proceed with the claim for refunds effectively.

At addwill we are at your disposal if you need personalized advice. You can contact us through the phone +34 934 875 200 or the email comunicacio@addwill.eu or by clicking here.